Buying your fantasy household doesn’t have to be difficult because good seasoned of the All of us. You forfeited throughout your whole profession for our marvelous nation and you may are entitled to so you can retire with cover. Plus nearest and dearest may be worth to go back so you can a lovely domestic they can name home if you are however serving and require a space off the ft.

Our team may help reach that goal with a good Virtual assistant Jumbo Financing, a home loan off Experts Situations. The federal government legislated they to have eligible veterans for example oneself, who want to invest extra into the a property might enjoy forever. It let you and you may effective-obligations servicemen and lady surpass the standard Va Loan Restrictions so you’re able to pick a higher-avoid family.

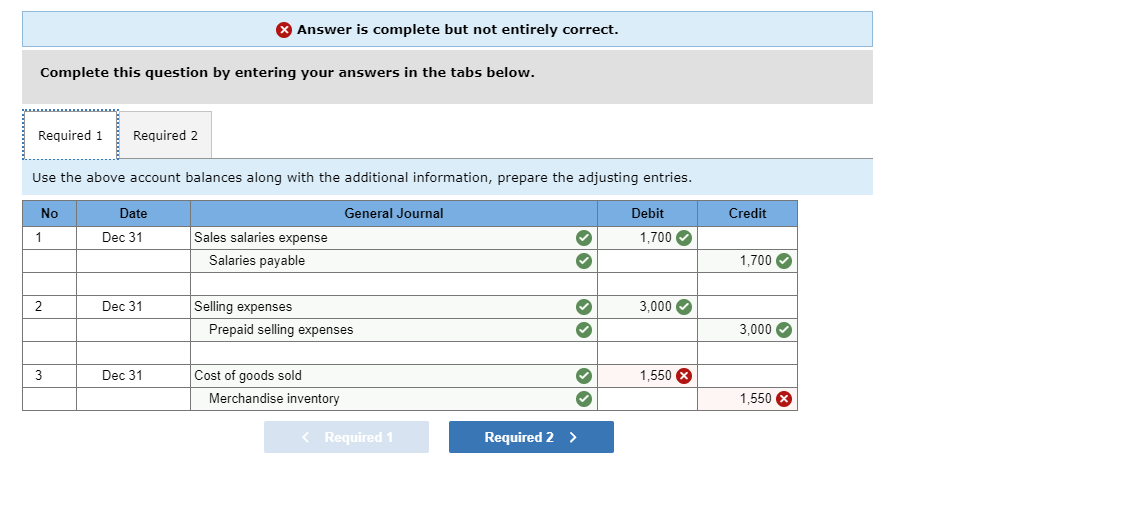

What exactly is a good Virtual assistant Jumbo Financing?

The same as a frequent Virtual assistant Financial, its a property funds choice designed for armed forces personell one this new Va backs. The real difference would be the fact a beneficial Va Jumbo Mortgage covers an amount you to definitely is higher than the regular loan limit. This type of mortgage brokers have been called non-compliant finance and generally are among the many different kinds of Virtual assistant fund.

Particularly, the Va Loan Maximum to own Washington and some federal areas when you look at the 2022 was $647,200 to own one-device family. You could take a look at government’s latest datasheet having compliant financing limitations in your kind of area.

Fortunately to possess pros would be the fact Jumbo funds commonly for particular home buyers. Of several have been under the incorrect trust you to definitely once the experienced financing considering special professionals they may not considering because style of mortgage. This will be a misconception, because pros also can get Jumbo funds when they meet up with the qualification standards.

Various other piece of good news having veterans is that they enjoys most competitive interest rates. While typical mortgage cost is actually .25 % and .5 % greater than traditional fund, veteran’s Jumbo financing are certainly not.

We recommend dealing with an experienced Virtual assistant financial being eligible to own a beneficial Virtual assistant Jumbo loan and purchase a deluxe senior years otherwise temporary family.

The fresh principle to have jumbo mortgage down repayments with other lenders is the fact you can shell out about 20%. And these come which have higher rates that push your lifetime home loan rates much higher. The nice development is the fact your house financing work with having Virtual assistant Jumbo Funds means the lender doesn’t require some thing.

While they wouldn’t ask you to build a downpayment, you need to pay the Virtual assistant Capital Payment, that is a-one-day payment to Veterans Issues. They costs 2.3% of complete amount borrowed however, works less than a straight down fee normally.

Such, you’d shell out $18,eight hundred as the a financing payment to have a keen $800,100 financial. This replacement for conventional off repayments manage help you save along with your spouse $141,6000. Virtual assistant Jumbo Money just make you increased home loan count than simply asked, however they can also save you hundreds of thousands of dollars.

Jumbo Money vs. Conventional Funds

Jumbo fund was money that will be getting a price which is higher than the regular financing amounts, which happen to be up to $647,two hundred for the majority of U.S. and you will $970,800 inside highcosts components when you look at the 2022. Freddie Mac and you can Fannie mae purchase loans regarding loan providers as well as have place maximum wide variety for a loan are considered a conventional conforming mortgage. Funds greater than one number are thought Jumbo financing.

- High rates

- Wanted high credit scores

- High income necessary

- Work record for a significantly longer time is needed

- Need to have the debtor for sufficient cash making a number of weeks regarding mortgage repayments

- Off money is 10 percent in order to fifteen percent greater than a beneficial traditional financing.

Pros can still purchase a costly house with good Jumbo mortgage. Although not, it takes a little computation to acquire best make certain wide variety and you can you can easily off money.

Out-of closing costs in order to month-to-month home loan repayments, we all know it is like the fresh listing from costs are endless. But these usually do not disqualify you from buying a costly domestic because long since you trust the fresh new VA’s support.

You should buy good Virtual assistant jumbo mortgage as much as $2 billion, and if you meet with the minimum credit history criteria as well as have full entitlement through the Va.

I indicates our servicemen and you can female discover a certificate away from Qualifications before getting an effective Va Jumbo Financing. A lender dont initiate the method as opposed to this called for file. Without having they currently, our team will get they on your behalf, saving you on problems.

While rates usually are maybe not high for experienced Jumbo funds, they might be highest. However the amount is still substantially less than if you’d need establish a down-payment towards a traditional Jumbo mortgage. New Seasoned Products system helps it be affordable to own army personnel to shop for a top-prevent, expensive house.

Brand new Company away from Experienced Affairs brings experts having a keen entitlement, that is a dollar they agree to pay back on veteran for the purchase of a home. Might entitlement is generally $thirty-six,100, however it is greater when all of the is considered and you will over. Really the only situation in which a seasoned will have to spend an excellent highest downpayment could well be if the obtained already used up certain of entitlement towards the a previous mortgage.

Virtual assistant Jumbo Finance has numerous advantages one to distinguish them of the typical financial choices. No advance payment requirements is a significant one and is real having simple Va Finance. To get a property with this specific virtue is only you’ll be able to from Va because the an eligible military associate.

Several other benefit of making use of a good Jumbo Va Mortgage is you won’t need private mortgage insurance coverage. Extremely homebuyers you to definitely set-out less than 10% you desire it in the eventuality of loan default. However, your educated Virtual assistant bank trusts Experts Products in addition to their be certain that to the the mortgage, to stop it payment.

Virtual assistant Jumbo Loan Requirements

If you find yourself one energetic-duty military group, experienced, otherwise enduring companion can obtain a Virtual assistant Jumbo Financing, the Va has actually private money and you may credit history criteria. Lenders tend to however remark your credit score and check the debt-to-earnings proportion (DTI), newest income, and other figures.

Qualifying to own a mortgage, particularly when you’ve offered from the military, is individual. You should communicate bad credit loan in Lincoln Park with a personalized Virtual assistant lender that may promote you designed advice on if or not you might proceed.

Am We Entitled to an effective Va Jumbo Financing?

Brand new Virtual assistant asks that you feel entitled to a normal Va Financial and you will satisfy financial-certain so you can progress which have an excellent Va Jumbo Financing. We are able to make it easier to along with your partner function with the procedure of having a Virtual assistant mortgage.

Its a venture one countless other home buyers have gone carried out with you and you will finished up in their dream belongings.

Still have questions or would like to know a lot more about how exactly to get a Va jumbo financing? You could get in touch with Jimmy Vercellino individually because of the getting in touch with 602-908-5849. Other class member tend to hook up one him when it is possible to when the he is offering other customers.