When a lending company are choosing whether or not you satisfy its standards for a loan, might look at the loans Lakewood issues that affect value. Your earnings yes affects what you can do to settle the mortgage and with an adequate money is important.

Lenders will during the number you have made facing their outgoings which may include loans costs, expenses, auto insurance and other travelling costs. If for example the most recent money you’ll comfortably defense your current outgoings because really since your new mortgage payments and you will any related can cost you, a lender may wish to approve you.

Which have a diminished money that may not expand to afford more than, might cause matter for some lenders, specifically if you have a low credit history. The representative can take the full time to listen what you you need out-of home loan and can estimate the lowest priced and you will feasible channel.

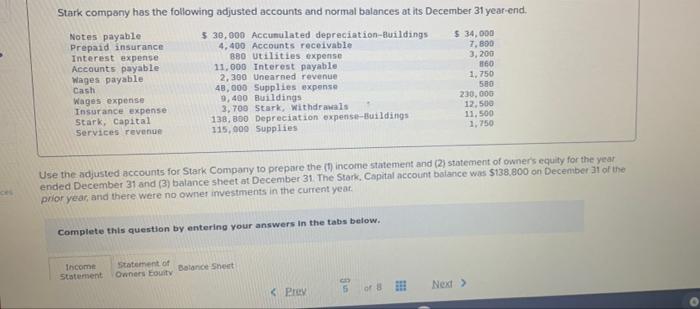

How much put can i rating a mortgage with a poor credit get?

It may be the fact that to access your favorite lender’s pricing and you may fulfill the words, you have got to put a top portion of the newest functions ount from deposit you should get a home loan vary dependent into the a complete servers regarding issues as well as your years additionally the brand of property we want to get.

There isn’t a consistent deposit proportions, however some loan providers query applicants to deposit up to 29% to possess home financing if they have a dismal credit score otherwise lowest value.

For a home valued in the ?two hundred,100 that would equate to an excellent ?60,100 put. Large deposits commonly a feasible option for loads of individuals and you can luckily for us you’ll find a small number of lenders one to understand this and could become more willing to provide below so much more flexible words.

Can i rating a home loan having a decreased credit history?

It can be reassuring to understand that which have a low credit get doesn’t rule out the possibility of a mortgage, specifically if you feel the help of a mortgage broker due to the fact they are able to quickly make suggestions where the loan providers try that have the ability to offer the newest money you need.

Particular lenders can even use the cause for this new bad credit under consideration, together with severity of condition just in case its already been fixed.

Basically – despite major and recent circumstances on the declare that has triggered a minimal credit score, this may still be you’ll locate home financing. Inquire a brokerage to test your credit score and you may supply a selection of related loan providers.

How to boost my personal credit score getting a mortgage?

Create any credit card money timely. This may avoid any later scratching on your credit history and you will impression.

Try not to make apps to possess borrowing from the bank in this 12 months off a good mortgage app. Talking about recorded while the ‘hard searches’ where a lot of of these look like you might be depending continuously into the credit that may perception your overall score.

Stay out of your overdraft and ensure your mastercard utilisation are lower – go after keepin constantly your balance lower than twenty five% because might help the rating and supply the feeling you to definitely you’re in power over your expenses.

Look at the credit history on a regular basis to keep towards the top of your own credit and have now a definite post on your financial situation and you will credit get.

How can i score something very wrong back at my credit history removed?

If you think that details about your credit report are wrong, you have the directly to argument it with the organization that provides joined the newest mistake. This can be a monotonous techniques however, errors toward credit profile is delay financial programs and certainly will prohibit you from supply on finest rates.