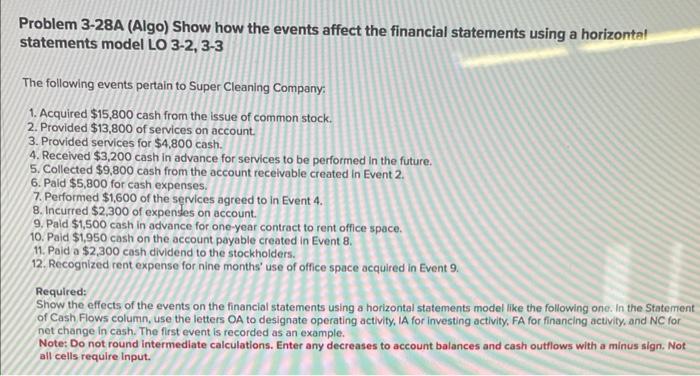

While the information on that it page is provided from the a professional business specialist, it has to not considered as judge, taxation, financial or financial support suggestions. Because the most of the person’s condition is special, an experienced professional should be consulted before making economic decisions.

From the pursuing the post, we will discuss in detail the fresh feeling one personal bankruptcy might have on the ability to receive a house equity financing (HEL).

We’re going to examine various style of bankruptcy filings and you may what you may come across whenever applying for an excellent HEL. We’ll plus speak about option choice that you could not alert of that is target your position most likely better yet than just good house security loan.

For individuals who otherwise somebody you know needs to know how to get a property collateral loan after case of bankruptcy while you might have one during the it, you ought to keep reading.

Providing a house Security Financing with a section 7 Bankruptcy

Let’s consider a couple of issues: if you’d like a house guarantee financing if you find yourself nonetheless going right on through personal bankruptcy, after which after the bankruptcy release. Please be aware the same regulations explained below affect providing property security personal line of credit (HELOC) whilst in otherwise once case of bankruptcy.

May i Rating property Collateral Financing While in A bankruptcy proceeding Bankruptcy proceeding?

Sadly, you would not be capable of getting a home guarantee mortgage whilst in A bankruptcy proceeding case of bankruptcy for a number of factors. Your property is mainly controlled by the new case of bankruptcy judge.

After you borrowed money order your household, you finalized a note (the mortgage) and you can a home loan (which is the lien). A bankruptcy proceeding case of bankruptcy wipes the actual mortgage, although it does maybe not get rid of the latest lien.

The financial institution normally foreclose on your household if you find yourself currently trailing on your money, or you fall behind on your money after while in the bankruptcy proceeding. If you are current on the repayments and will demonstrate that you’ll be able to still make your repayments, the financial institution enables you to keep the home.

In the Chapter 7 bankruptcy, you give up your non-excused assets to settle as frequently of one’s financial obligation that one may. The new bankruptcy trustee allotted to your own circumstances gets done expert during these assets. Any house that’s not excused off their fool around with would-be marketed to blow creditors.

If you have plenty of security of your house, except if your state exempts all security, the latest trustee will sell your home to utilize the fresh new equity. They’ll afford the lender so that the lien La Jara loans is completely removed, spend you the exempted percentage of their equity, and rehearse the remainder to blow creditors.

Even in claims one entirely exempt the guarantee of your home, people collateral which is turned dollars whilst in bankruptcy was no further excused. An excellent trustee would not allow you to accessibility brand new guarantee by turning it into cash.

Must i Score a house Equity Loan Once a part seven Bankruptcy proceeding Discharge?

Once the a chapter eight bankruptcy will leave at the least a few of the loan providers without getting completely reduced, their borrowing from the bank might be seriously inspired for quite some time. The latest bankruptcy proceeding will remain in your credit report getting ten years. not, for individuals who focus on fixing their credit, you should buy a house security loan just before up coming.

Antique lenders make their own dedication from the once they usually consider an application of anyone who has been in personal bankruptcy. You could find specific loan providers who’ll think about your app immediately following three-years features passed.

Most lenders will need a waiting ages of 5 to 6 decades. Brand new waiting several months initiate in the event your personal bankruptcy might have been discharged.

Federal Homes Expert otherwise FHA funds be much more easy. They’ll accept a diminished credit score to help make the loan, and you will a higher mortgage to help you worth ratio with a failure get. You can purchase an enthusiastic FHA loan couple of years pursuing the case of bankruptcy launch.

Consider, all this assumes you have repaired your own borrowing from the bank and this you have adequate equity of your house so you’re able to be eligible for an enthusiastic collateral loan.