No cash down home loans are pretty hard to come by now. But there is however however a first-day homebuyer mortgage that exist with no down-payment. While don’t have to spend home loan insurance loans Williamsburg otherwise highest desire prices.

This is the USDA Outlying Invention Loan, which can be called this new “forgotten” financial program. Eg and you can FHA otherwise Va financial, it is a home loan guaranteed by the You.S. regulators, however it is one that’s often missed by many basic-time homeowners.

Zero-down mortgages

That will appear unusual, as USDA loans provide some extremely glamorous conditions. You should buy a no money down mortgage (100 percent financing) while not having to buy PMI and other kind of of home loan insurance rates. Borrowing from the bank requirements is actually small – you could be considered having a credit score only 620 – and there is no restrict to the merchant concessions or the use out of gift ideas to fund settlement costs.

USDA financing as well as will let you plan within the financial support to spend getting solutions or necessary improvements for the assets, borrowing as much as 102 percent of your “improved” property value the house included in the mortgage. You are able to refinance particular qualified mortgages using an effective USDA domestic financing.

Zero financial insurance coverage

In addition prevent paying for home loan insurance, that’s generally speaking requisite into the mortgage loans with less than an excellent 20 per cent down payment. As an alternative, borrowers shell out one to-date percentage equivalent to dos per cent of the loan amount. Which is much cheaper than mortgage insurance, and that generally works regarding one to-half to 1 % of amazing amount borrowed a-year.

All the USDA loans was “simple vanilla” fixed-price mortgage loans, so that you won’t need to value complicated keeps including varying prices, balloon costs otherwise fund instance adjustable-rates mortgages (ARMs). And you will costs try similar as to what you’ll get having a normal home loan.

USDA eligibility

The applying does come with particular restrictions. You’ll find constraints about how exactly far earnings you can have and you may how much cash you could expend on a home beneath the system. Therefore do not make use of it to acquire a property inside an enthusiastic urban area he or she is named “rural advancement loans” whatsoever. But the concept of “rural” is pretty broad and you can boasts enough quick cities and you may residential district parts.

The fresh new USDA earnings constraints for an outlying invention mortgage are 115 % of one’s median household members earnings into urban area you’re purchasing into the, modified having relatives proportions. Used, that usually mode a max income out of $103,500-$136,600, although it normally exceed you to definitely matter for the highest-worthy of portion, and also wade more more than you to definitely within the look for teams.

USDA eligibility guidelines indicate you need to currently lack “adequate” homes, regardless of if that’s offered to interpretation. That can imply a recent house that’s for the bad status, however it is also a condo otherwise house which is too brief available.

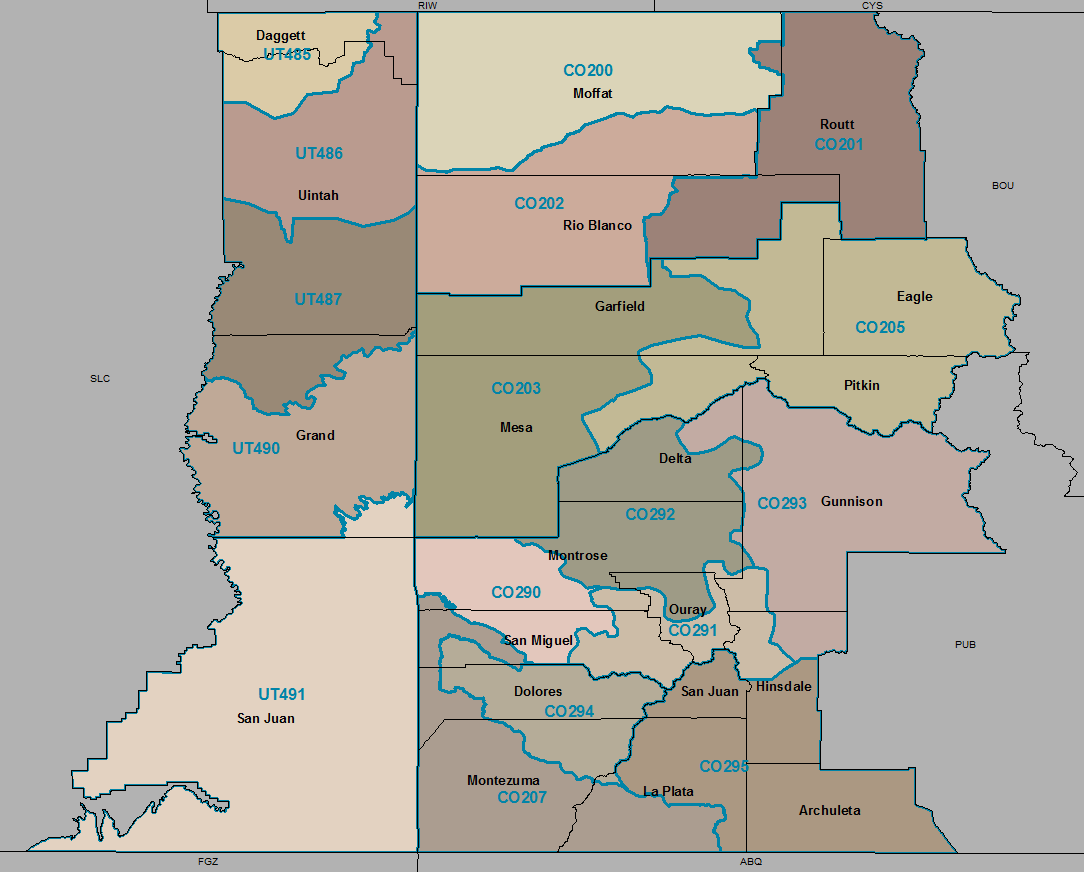

The definition of “rural” around USDA assets qualification recommendations boasts small teams all the way to thirty-five,100000 population that covers an abundance of outlying areas as much as larger locations. You will see a beneficial USDA possessions qualification map and have outlining earnings direction on agency’s Earnings and you will Property Qualification webpage.

Getting an excellent USDA home loan

USDA finance are supplied because of a limited level of USDA-approved loan providers. To find that, look at the USDA Outlying Development site to own a list of recognized loan providers towards you. There are also a great USDA financing mentor who will let you notice ideal program for you.

The fresh new USDA Outlying Creativity Loan System actually talks about 2 kinds of fund, USDA Single Relatives Lead Casing Finance and also the USDA Solitary Family relations Protected Financing System. The fresh eligibility and you may loan advice are different for every single, but generally, the latest Head Houses Financing system is made for low income individuals and that’s more minimal with what it will fund. A USDA loan mentor, in the list above, makes it possible to determine which you’re qualified to receive.

Financial support to the USDA Outlying Creativity Mortgage Program, which comes regarding the government, is restricted towards annually-by-season basis, as there are often a standing number to-be accepted to possess these finance. But if you won’t need to pick a home straight away, the brand new USDA home loan program might be a practical and you may very sensible first-go out homebuyer system.