In the India, individuals aspires so you can residential property a significant business, secure an effective salary, or initiate her organization and complete the fresh lifelong dream about becoming a resident. Yet, into ascending price of property and you can possessions, home ownership is easier told you than just over. For folks who focus on a reputed company and then have good annual salary package, you might effortlessly get home financing without much hassle. Exactly what regarding people who find themselves notice-functioning?

Well, home loans getting thinking-working are once the worthwhile in terms of salaried advantages. Yet , many people are in the dark with regards to knowing the qualification requirements, the fresh new data called for or any other variations in the house funds for both. Care and attention perhaps not, given that we are right here to clear all of your current misunderstandings and you may doubts.

Home loan Qualification to possess Mind-Employed

Of a lot worry about-employed some one value simply how much scrutiny they’ve so you can face because the mortgage people. Whatsoever, they may not have a steady stream of money instance salaried some body. Would certainly be happy to remember that our home financing qualifications getting mind-operating is really relaxed in today’s date. Like all people, the mortgage application’s profits have a tendency to generally rely on a host of factors:

- Ages When you yourself have decades on your side, you can earn far more beneficial mortgage conditions out of your financial. Hence, younger worry about-operating individuals provides most readily useful qualification and will get themselves of a good prolonged tenure also.

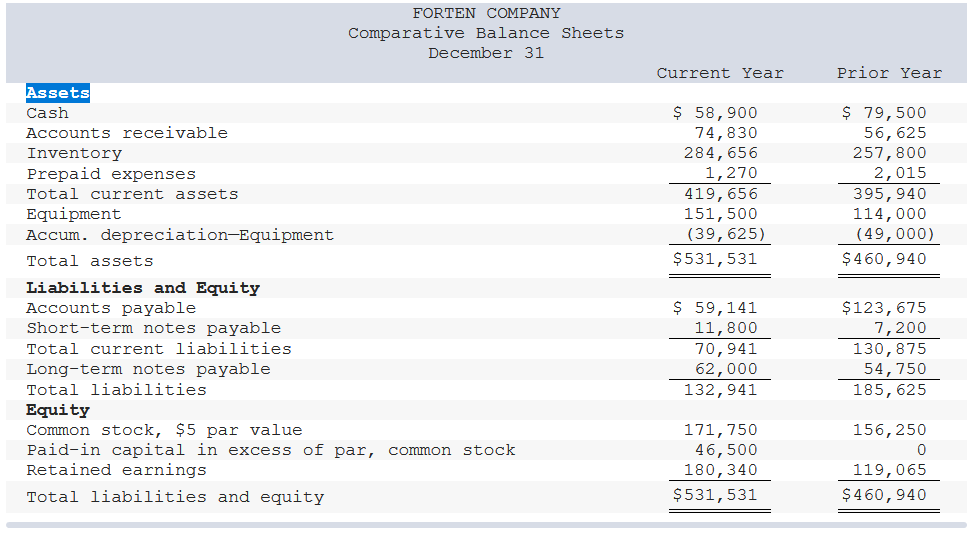

- Money To have mind-employed individuals, evidence of regular income situations heavily yourself mortgage qualifications criteria . Generally, your own bank will need tax productivity throughout the prior 3 ages and you may funds, losings and you can harmony statements of one’s team.

- Providers continuity Evidence of company life as well as success as well as weighing greatly in the houses loan qualification. A lengthy-powering, sustainable, and you can profitable organization is a sign of an excellent financial cost capability.

- Creditworthiness The lender as well as establishes whether or not you’ve got any kind of present loans, bills, otherwise defaulted money before signing out-of on mortgage. Your credit score is a good signal of your creditworthiness.

Financial Data to possess Mind-Employed

Whether you are a candidate or co-applicant, the list following off home loan data files same day loans Notasulga having worry about-working will come in helpful if you find yourself trying to get good homes financing:

- Address Research Aadhar cards, Passport, Riding Licence, Phone Statement, Ration Credit, Election Credit, and other certification off statutory power,

- Age Research Pan Credit, Passport, and other associated certificate of a statutory power

- Income Research Proof organization existence, last three-years taxation output, accountant-formal harmony sheet sets, and you can past 1 year savings account statement

- Possessions Records A duplicate of agreement getting assets pick

- Instructional Certificates Evidence of degree otherwise knowledge Understand about new records required, just click here .

Home loan Interest rates for Worry about-Working

Prior to going in the future thereby applying to own a houses mortgage having self-employed, you need to know one to home loan rates of interest having worry about-working people disagree somewhat off those individuals to own salaried people. The cause of it is simple: you will find a slightly higher risk on lender if this relates to the previous.

Recall regardless of if these interest levels change from day to time. Since the a home-functioning applicant, you also obtain the solution to select from a drifting interest price and you will a predetermined interest rate . not, repaired interest rates is higher and you may scarcely readily available than drifting rates. The rate of interest was revised if you have a movement on the PLR rates.

All of those other stipulations, like the financial tenure plus the quantity of home loan you to a self-operating candidate can apply to possess is actually as per business norms:

Achievement

Before applying to have home financing while the a home-functioning personal, ensure that all your valuable records was up-to-big date and in a position, specifically income tax efficiency and you can business ledgers. A good time to apply for home financing happens when you are doing better in your providers, lack high debts and have a credit history 750+. You could get a great salaried co-candidate to improve the possibility.