A residential property prices for the California have been rising has just. The latest average property value property on county is currently as much as $506,one hundred thousand. An average record price is slightly below $500,000. For each and every sq ft, the typical listing pricing is $296.

These number are a while greater than the national mediocre, in which the average family worthy of consist within less than $201,100. The common listing rates throughout the U.S. is just north out-of $258,100000. Into an each-square-foot basis, so it results in $139. This new Federal Relationship out-of Realtors including prices the common house rate in america as somewhat less than $260,one hundred thousand. Very California is roughly twice as high priced while the rest of the country.

While the group transferred to functioning remotely one to managed to move on nearby genuine house likewise have and you may demand equilibrium, ultimately causing San francisco bay area average rents getting facility renting to-fall 31% seasons more 12 months from inside the

According to California Relationship from Realtors (C.An effective.Roentgen.), this new average marketing price of resold solitary isolated property regarding the condition merely below $550,one hundred thousand. This rates does vary from region in order to area. Santa Clara is much more pricey than Riverside, like.

Costs of the Julesburg loans latest detached home have a tendency to without a doubt be higher than existing home. When you look at the Salinas, brand new residential property generally sell for $350,000 as much as $970,000. Within the Orange State, the fresh new land choose $eight hundred,000 to almost $5,100,000.

C.A great.R. including cards the median price of condos during the California is actually a bit a lot more than $443,one hundred thousand, a tiny improve compared to earlier in the day figures. San francisco, where you can find Twitter or any other technology startups, gets the most high-priced apartments having the average selling price of up to $step one,two hundred,000; when you find yourself Fresno sits at the end of your own survey at shorter than just $132,one hundred thousand.

According to the S&P/Case-Shiller House Rate Directory, that is one of several state’s really implemented indications for household values, real estate pricing into the Ca are rising. That is genuine having multiple inhabited parts. There’s no sign of it improve delaying, therefore to purchase a house into the Ca, when you are expensive today, are only able to be anticipated to be higher priced regarding the close upcoming.

On the Federal Housing Financing Agencies (FHFA) increased compliant mortgage restrictions from the eight

From very first 3 house out of 2020 home organized much better than it did for the 2008 real estate recession. Central finance companies and you will people in politics reacted shorter plus aggressively so you can the fresh COVID-19 crisis than simply they did to your 2008 market meltdown. Of a lot novel and you can strange regulations which began in reaction to the earlier in the day credit crunch were used way more aggressively inside recession. For-instance, listed below are some of your own policies which have been introduced:

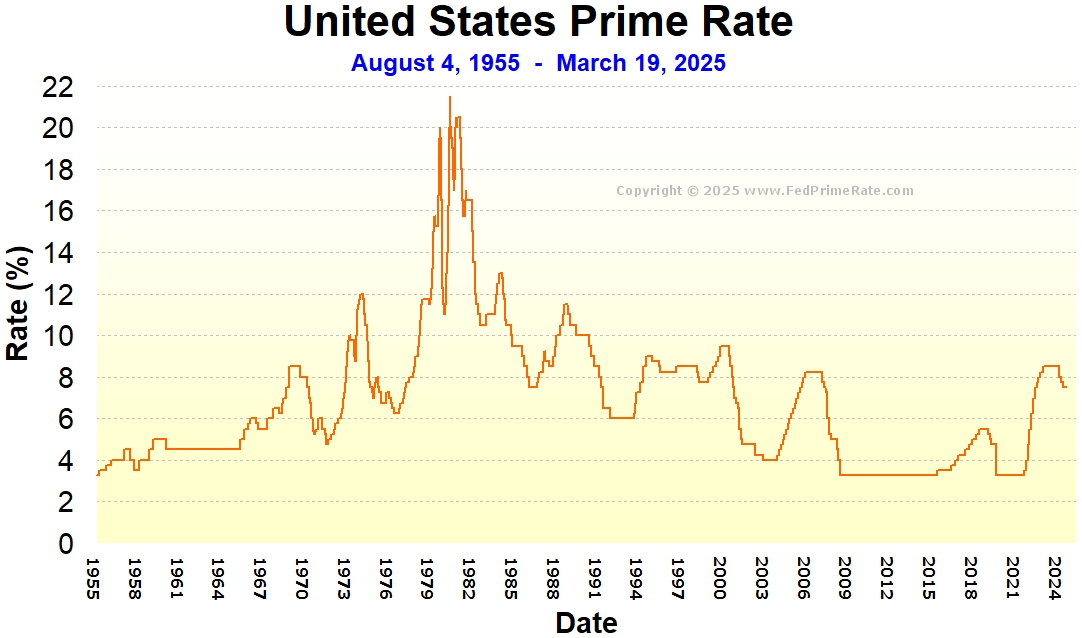

- The latest Government Set-aside rapidly fell the fresh Given Finance Price so you’re able to zero if you find yourself indicating they would pick an unlimited number of Treasury bonds and you will mortgage-backed bonds to store those segments practical.

- For the 4 months the Federal Put aside lengthened its harmony sheet because of the over $step 3 trillion out-of $cuatro trillion to over $seven trillion.

- Brand new Federal Reserve considering forward information stating they were impractical to help you lift interest rates as a result of 2023.

- Jobless positives was in fact stretched into the years, number, in order to individuals who previously could not qualify for jobless like self-working anyone.

- The CARES act is a great $dos.dos trillion financial stimulus expenses. They banned evictions to have shortage of book payment and you may banned foreclosure to possess shortage of mortgage repayments while enabling homebuyers so you’re able to fee forebearance for approximately 360 days.

- From the 2008 economic criss the FASB didn’t relax . From inside the 2020 home-based & international regulators worked more easily to regulate monetary reporting conditions.

Particular large tech people particularly Twitter provides promoted the job-from-home movement and you will Pinterest paid off $89.5 billion to split an enormous book inside the Bay area.

The online away migration in the Bay area has also been shown in latest aggregate transformation income tax analysis. If it development goes on it might be the third crash to have the fresh San francisco a home property drama was preceeded of the swallowing of your Dotcom bubble for the .