Town Tempo-Upto fifty% From

Once i is probably take out a home loan towards the my personal salary out-of Rs. forty,000, We entitled my Banker buddy. I inquired your exactly how much mortgage ought i log in to 40 000 paycheck. He said the loan amount should be somewhere within Rs. 25 – Rs. twenty-seven lakhs.

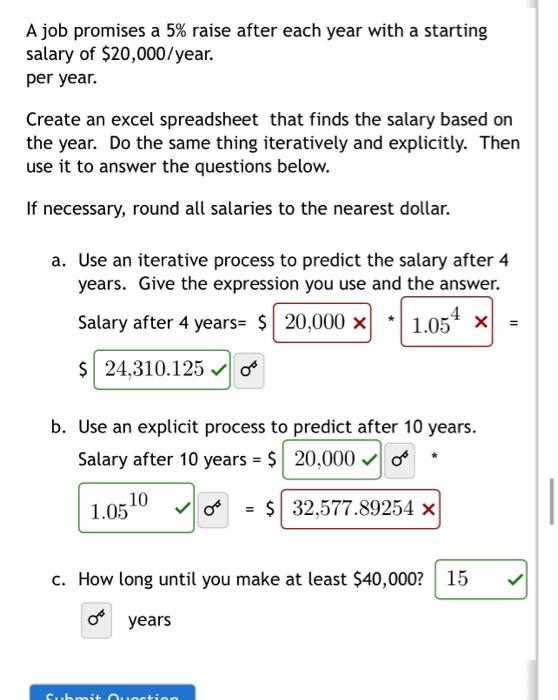

He states, the quantity he only mentioned is on mortgage off 8.4% p.a good. and a loan period from 3 decades. To learn about the number, the guy told me to utilize the NoBroker mortgage eligibility calculator.

From there, I was capable of seeing the mortgage to your 40000 income you to definitely I am able to score, which had been exactly Rs. Lakhs. I really hope that it responses the inquire precisely how much housing loan should i log on to 40000 salary.

Urban area Tempo-Upto 50% Out of

Few years straight back, whenever my personal income is 40000, I took aside a mortgage. Very, the first thing that I did so shortly after visiting the bank were to query the borrowed funds government, “Exactly how much financial can i rating having 40000 income?

He told me that i try eligible for an expense one can be approximately Rs24 so you’re able to Rs26 lakhs. The guy explained that i you may boost my financial qualification in the event that want a loan which have a high matter. Check out of details said because of the him.

Centered on my friend, banking companies court some body predicated on the credit scores. Its fairly possible for those with a credit rating out-of 750+ in order to safe financing and have a top number. Whether your credit history try less than 750, then informed me to change they if you are paying from all of the the latest EMIs and you can credit expenses.

The fresh new stretched the newest tenure, the greater time you’re going to have to pay the mortgage. The guy mentioned that, easily picked a lengthier period, the fresh EMIs would be lower as well.

Going for a combined mortgage is another smart way adjust house financing qualification the https://availableloan.net/installment-loans-nh/ guy said. When going for a joint mortgage, the cash of each other people are thought by bank.

Very, which is how much cash home loan to have 40000 income, you can expect. You might proceed with the more than tips to improve your home loan qualifications as well. I am hoping the inquire regarding how much mortgage can i get which have 40000 income has been resolved.

Area Tempo-Upto fifty% Away from

Mortgage brokers with various debtor-friendly courses have made it easier if you have reliable incomes becoming residents on a young age as a result of the skyrocketing price of a residential property. I was one child whom questioned my personal paycheck is 40000 should i get property? Immediately after enough time discussions using my mothers and you may thorough search, Used to do sign up for a mortgage.

During the means of obtaining a home loan getting 40000 salary, We realized that the processes is simple: new borrower allows a lump sum on the bank so you can buy the house or property, and additionally they upcoming go back the borrowed funds through a few equated monthly instalments (EMIs) that come with attention.

The fresh approved amount of mortgage towards the 40000 paycheck, fluctuates, nonetheless, with respect to the applicant’s amount of earnings. An excellent jobholder’s main concern when making an application for a mortgage try for this reason how much they’ll be in a position to acquire. Its generally acknowledged that loan qualifications develops having income because the a guideline. However, there are certain figure at the job.

40k paycheck financial qualification criteria

Age: However this is favour credit currency to young borrowers between your decades of 21 and you can 55 to have home loans. Young people possess a top risk of paying off the loan since might almost certainly functions offered.

Manager and performs sense: Due to the coverage with it, applicants who do work for known people has actually a top danger of delivering a property financing recognized. New borrower provides the guarantee that its EMIs could well be paid off punctually thus. The employment record is essential and you can reflects really in your stability.

Credit score: Even although you make an effective lifestyle, a minimal credit rating can hurt your odds of qualifying getting home financing. However this is usually require a credit history from 700 or maybe more.

Established financial obligation (also known as Fixed Responsibility so you’re able to Income Proportion otherwise FOIR): The fresh new FOIR methods how much of another person’s month-to-month net gain visits paying their full month-to-month requirements. To possess eligibility, a threshold off less than 50% is normally expected.

LTV (Mortgage to Value): Even when the websites monthly money is larger, creditors is only going to funds as much as 75 so you’re able to 90 for every cent of whole price of a house. In case there is a standard, this will make it easy to reclaim the bucks because of the offering the root resource.

Property’s judge and you can technology approval: Creditors evaluate applicants who are offered to invest in a property built into a couple of conditions. First, the property have to have a definite label and proprietor, and then it should has a good market really worth. These types of tests are generally accomplished by unbiased lawyer and you may valuers one to financial institutions enjoys leased.

How much cash house financing must i log on to 40000 paycheck?

You will be curious what kind of home loan youre entitled to according to your monthly salary. Its a valid situation because figuring out brand new property’s budget depends on just how much out of a property mortgage you be considered for. Banking companies normally agree lenders having 20 so you’re able to 3 decades that have monthly installments you to equivalent fifty% of your borrower’s web salary. Your own monthly repayment effectiveness was Rs 20,000 if the websites wage try Rs forty,000. (50 % of income).

You will be offered that loan around Rs 24-twenty-six lakh. You can change the aforementioned details according to debt requirements locate an even more precise estimate of the home loan amount.